History of Living Wages

The History of Living Wages in the U.S.

The original federal minimum wage in the United States was established in 1938 with the Fair Labor Standards Act (FLSA) and has changed significantly over the past 80+ years, both in how it’s determined and how it compares to economic realities. The first federal minimum wage was set at $0.25 per hour in 1938 with the stated purpose of establishing a “minimum standard of living” to protect workers’ health and well-being, to combat poverty and to protect hourly workers from exploitative labor practices, and to stimulate the economy by increasing workers’ purchasing power. While federal minimum wages were not tied to a specific economic formula, they were intended to reflect a basic living wage—enough to support an individual working full time at a modest level.

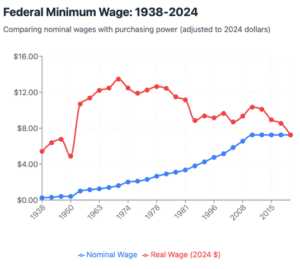

Since its conception, the federal minimum wage standard has been raised 22 times by Congress since 1938. As of 2024, it remains $7.25/hour, a rate that has been unchanged since 2009—the longest period without an increase. Given the inflationary impact of cost-of-living increases, the purchasing power of the minimum wage standard has declined over the past 50 years. Adjusted for inflation, the real value of the minimum wage peaked in 1968, when it was equivalent to over $13/hour in 2024 dollars. Since then, its real purchasing power has eroded, making it harder for minimum-wage earners to afford housing, healthcare, and other essentials.

Part of the original intent of establishing hourly wage rates was to align the cost of living and productivity. However, the federal minimum wage is not indexed to inflation, so it loses value without Congressional action. Meanwhile, worker productivity has far outpaced wage increases. Since 1979, productivity has risen by over 60%, while real wages have remained nearly flat. Because of political resistance to increasing the federal minimum wage standard, there has been an increased reliance on state and local legislative action, resulting in many states and cities now having higher minimum wages than the federal level. For example, in 2024, California’s minimum wage is $16.00/hour; Washington State’s is $16.28/hour.

Economic Attitudes in Texas Regarding Minimum Wage Standards

During the past 40 years, the political leadership in Texas has emphasized a business-friendly environment with minimal regulatory intervention. This approach includes maintaining a low minimum wage to attract and retain businesses by keeping labor costs predictable and low. The belief is that minimum wage regulations foster job creation and economic growth. While over 30 states have adopted minimum wages above the federal standard, the State of Texas minimum wage standard remains at $7.25/hour. To maintain this low-wage mentality, the Texas legislature passed a law in 2003 that prohibits cities and counties from setting their minimum wages higher than the state level. This preemption means that even if local governments wish to address higher living costs in their areas by increasing wages, they are legally restricted from doing so. Opponents of raising the minimum wage in Texas argue that such increases could lead to job losses, particularly for low-skilled workers, as businesses might reduce hiring or turn to automation to offset higher labor costs. They contend that market-driven wages are more effective in reflecting the economic realities of different regions. In 2023, Texas further reinforced this state government’s resistance to worker economic health with the passage of the Texas Regulatory Consistency Act, a law that preempts local governments from enacting ordinances that regulate employment practices beyond what is stipulated by state law. This includes regulations related to employment leave, hiring practices, breaks, employment benefits, scheduling practices, and other terms of employment. The act aims to create uniformity in regulations across the state, thereby limiting the ability of municipalities to address local labor concerns through independent legislation.

Prosper Georgetown is a 501(c) 3 non-profit organization certified under File Number 803442241

by the Office of the Secretary of State for the State of Texas, dated 10/10/2019.